The Wealth Management Platform Market has experienced significant growth in recent years, driven by advancements in technology and the increasing demand for comprehensive financial services. Wealth management platforms are integrated solutions designed to offer a range of financial services to individuals and organizations. These platforms combine portfolio management, financial advice, trading capabilities, risk management, and compliance functionalities into one unified system, making them essential for wealth advisors, investment firms, and banks. As of 2024, the market is on track to expand further, with key innovations in cloud computing, AI, blockchain, and big data analytics expected to accelerate growth.

Market Dynamics

The wealth management platform market is influenced by several dynamic factors that impact its growth trajectory. One of the primary drivers is the rising demand for efficient, automated wealth management solutions that enable financial professionals to offer personalized services at scale. As clients seek tailored financial advice and diversified portfolios, the platforms that integrate AI, machine learning, and big data analytics are gaining popularity for their ability to provide deeper insights and predictive analytics.

Click to Request a Sample of this Report for Additional Market Insights:

https://www.globalinsightservices.com/request-sample/?id=GIS22319

The need for enhanced regulatory compliance and risk management is another important factor contributing to market growth. With increasing scrutiny from regulatory bodies, wealth management platforms that incorporate compliance monitoring and reporting features are in high demand. Additionally, the shift toward cloud-based platforms is reshaping the industry, providing greater flexibility, scalability, and security to financial institutions.

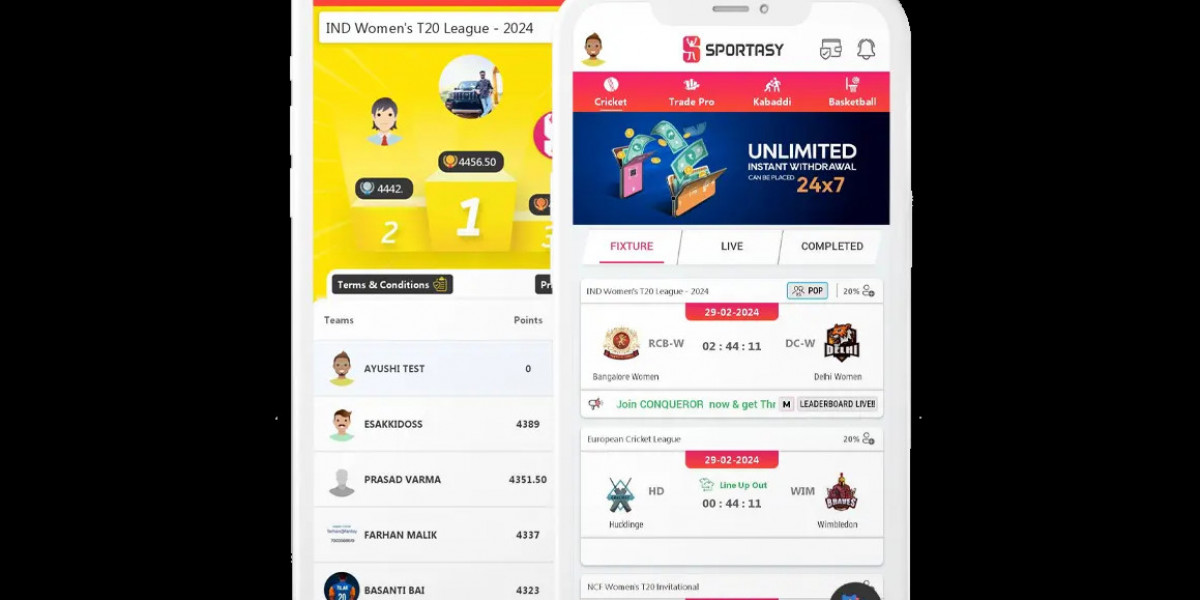

The increasing adoption of mobile-based and web-based platforms is also contributing to the market's expansion. As more investors turn to mobile apps for managing their portfolios, the demand for robust and user-friendly mobile-based solutions is surging. This trend is expected to continue as millennials and younger generations show a preference for managing their finances through digital platforms.

Key Players Analysis

Several key players dominate the wealth management platform market, providing innovative solutions to meet the growing needs of the financial services industry. Leading companies in this space include:

Temenos: Known for its comprehensive suite of wealth management solutions, Temenos provides cloud-based platforms that support portfolio management, trading, and compliance functionalities.

Fidelity Investments: A major player in wealth management, Fidelity offers both cloud-based and on-premise solutions for portfolio management, financial advice, and trading.

Envestnet: Specializing in wealth management software, Envestnet focuses on integrating big data and AI to provide personalized financial planning and portfolio management tools.

SS&C Technologies: Offering a range of wealth management solutions, SS&C Technologies provides services such as risk management, compliance, and performance analytics to wealth advisors and asset management firms.

Orion Advisor Services: Orion provides a cloud-based platform offering portfolio management, performance reporting, and financial planning tools to wealth managers and advisors.

These players are continuously investing in research and development to improve their offerings, with a focus on incorporating new technologies like blockchain, AI, and robotic process automation (RPA) into their platforms.

Regional Analysis

The wealth management platform market is witnessing strong growth across various regions. North America, particularly the United States, holds a dominant position in the market due to the presence of numerous wealth management firms and high adoption rates of advanced technologies. The region's strong financial infrastructure and regulatory framework further boost the demand for wealth management platforms.

In Europe, countries like the UK and Switzerland are key markets, with a growing number of banks and financial institutions embracing digital transformation. The increasing demand for wealth management solutions that offer better regulatory compliance and risk management functionalities is driving market growth in this region.

Asia-Pacific is expected to see the highest growth rate during the forecast period. The rapid economic development in countries like China, India, and Japan, coupled with the growing number of high-net-worth individuals (HNWIs), is propelling the demand for advanced wealth management platforms. The region's adoption of cloud-based solutions and mobile platforms is further accelerating the market's expansion.

Recent News & Developments

The wealth management platform market has seen several notable developments in recent years. Companies are increasingly integrating cutting-edge technologies like blockchain and artificial intelligence into their platforms to enhance security, automate processes, and provide better customer experiences. Additionally, partnerships between fintech companies and traditional banks have become more common, enabling financial institutions to access advanced wealth management tools and expand their customer base.

Another major development is the growing shift toward hybrid deployment models, combining the best aspects of both cloud-based and on-premise solutions. This approach allows financial institutions to maintain control over sensitive data while benefiting from the scalability and flexibility of the cloud.

Browse Full Report @ https://www.globalinsightservices.com/reports/wealth-management-platform-market/

Scope of the Report

This report provides a comprehensive analysis of the wealth management platform market, covering key aspects such as market size, growth trends, technological advancements, and the competitive landscape. It examines various types of platforms, including cloud-based, on-premise, and hybrid solutions, and explores the different services, technologies, and components that drive the market. The report also includes an in-depth regional analysis, highlighting growth opportunities in North America, Europe, and Asia-Pacific. Key players and their strategies are analyzed to provide insights into the competitive dynamics of the market.

The scope of the report includes a detailed examination of the wealth management platform market from multiple angles, offering valuable insights for businesses, investors, and other stakeholders looking to understand the current landscape and future prospects of this rapidly evolving industry.

Discover Additional Market Insights from Global Insight Services:

Secure Access Service Edge (SASE) Market:

https://www.globalinsightservices.com/reports/secure-access-service-edge-sase-market/

Data Annotation Tools Market:

https://www.globalinsightservices.com/press-releases/data-annotation-tools-market/

Jobsite Management Software Market:

https://www.globalinsightservices.com/reports/jobsite-management-software-market/

Patent Analytics Market:

https://www.globalinsightservices.com/reports/patent-analytics-market/

Spatial Computing Market:

https://www.globalinsightservices.com/reports/spatial-computing-market/