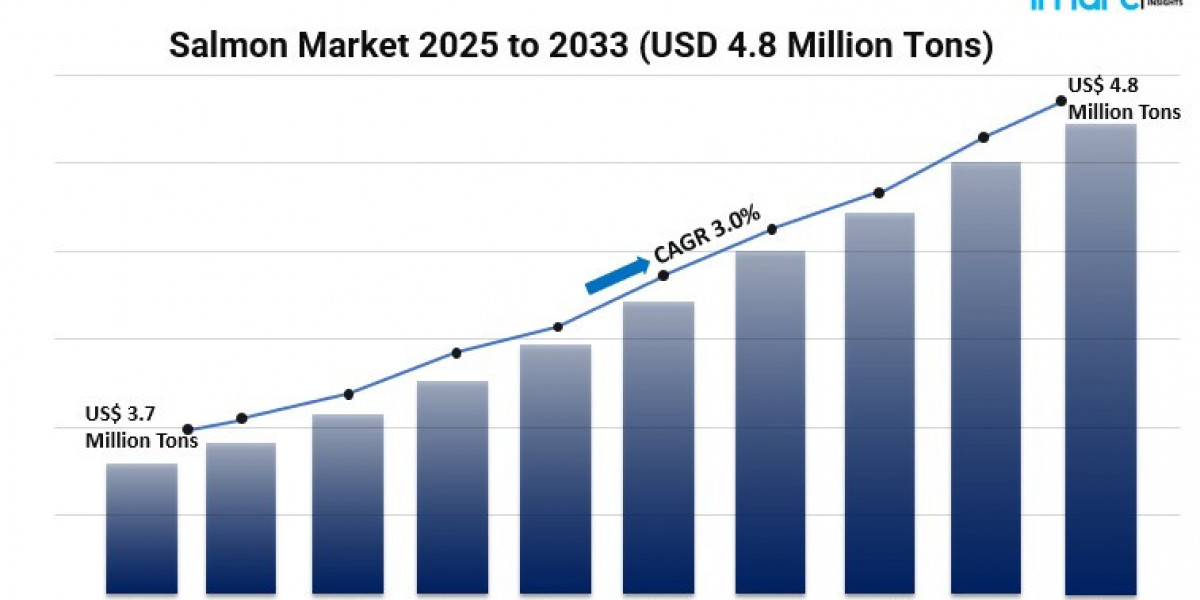

The global salmon market is experiencing steady growth, with the market size reaching 3.7 million tons in 2024 and projected to expand to 4.8 million tons by 2033, reflecting a 3% CAGR. This growth is fueled by increasing seafood consumption, rising disposable incomes in emerging economies, supportive government policies, and a growing demand for value-added salmon products. Additionally, advancements in aquaculture technology and sustainable farming practices are enhancing production efficiency and environmental sustainability, further propelling market expansion.

Study Assumption Years:

- Base Year: 2024

- Historical Year: 2019–2024

- Forecast Year: 2025–2033

Salmon Market Key Takeaways:

- Market Size & Forecast: The global salmon market was valued at 3.7 million tons in 2024 and is expected to reach 4.8 million tons by 2033, growing at a CAGR of 3% during 2025–2033.

- Dominant Species: Atlantic salmon currently holds the largest market share among various species.

- Preferred End Products: Frozen salmon is the most popular end product, favored for its longer shelf life and ease of transportation.

- Leading Distribution Channel: The foodservice sector accounts for the majority of the market share, driven by the versatility and culinary appeal of salmon in various dining establishments.

- Regional Insights: The European Union leads in salmon consumption, holding over 46.3% of the global market share in 2024.

- Technological Advancements: Investments in aquaculture technology are enhancing disease resistance and overall yield.

- Sustainability Initiatives: Government policies and certifications like MSC and ASC are promoting sustainable farming practices.

What Are the Key Growth Drivers in the Salmon Market?

Technological Advancements in Aquaculture

Tech boosts in fish farming are key to the growth of the salmon market. New tools like RAS & feed that is good for the earth help make more fish & less waste. These techs help fight off fish illness, speed up growth, & get more fish, making the job greener & cheaper. Tools such as blockchain for tracking & auto checks make sure of quality, gaining trust from buyers.

Supportive Government Policies and Initiatives

Gov help shapes how the salmon market grows. Plans like PMMSY in India aim to boost fish farms with 7 million more tons of fish & a big rise in sales by 2025. Such plans push money into new fish farm tech, fight fish illness, & back good fish farm ways, thus helping the market grow.

Rising Consumer Demand for Sustainable and Value-Added Products

Buyers now want green & added-value salmon more. As folks get more health-aware, they seek good food like salmon, rich in omega-3 & key stuff for health. Also, the like for fish good to eat fast, marinated, & smoked, is growing, meeting the need for ease without cut in taste. OKs from groups like MSC & ASC pull in green-minded buyers, pushing market growth.

Market Segmentation:

Breakup by Type:

- Farmed: Dominates the market, accounting for the majority share due to controlled breeding and consistent supply.

- Wild Captured: Represents a smaller segment, with fluctuations based on fishing yields and environmental factors.

Breakup by Species:

- Atlantic: The most consumed species globally, known for its rich flavor and high fat content.

- Pink: Typically smaller and leaner, often used in canned products.

- Chum/Dog: Valued for its firm texture and used in various culinary applications.

- Coho: Recognized for its delicate flavor and tender texture.

- Sockeye: Known for its deep red color and robust taste.

- Others: Includes various lesser-known species with niche markets.

Breakup by End Product Type:

- Frozen: The most popular end product, favored for its longer shelf life and ease of transportation.

- Fresh: Preferred for its taste and texture, though requires more stringent storage conditions.

- Canned: Offers convenience and longer shelf life, catering to a wide consumer base.

- Others: Includes products like smoked, marinated, and ready-to-eat salmon.

Breakup by Distribution Channel:

- Foodservice: Accounts for the largest market share, driven by the versatility and culinary appeal of salmon in various dining establishments.

- Retail: Includes supermarkets, hypermarkets, and online platforms, catering to the growing demand for home consumption.

Breakup by Region:

- Europe: Dominates the market, with the European Union holding over 46.3% of the global market share in 2024.

- North America: Significant market presence, with the United States being a major consumer.

- Asia-Pacific: Emerging market with increasing consumption, particularly in countries like Japan and China.

- Latin America: Growing market, with countries like Chile being key producers.

- Middle East & Africa: Niche market with potential for growth.

Which Region Dominates the Global Salmon Market?

The EU tops the global salmon market with 46.3% in 2024. This lead comes from high eat rates, old fish farm ways, & strong sell nets. Places like Norway & Scotland are key, adding to the market share. Also, the EU's push for green farm ways & OKs like MSC & ASC lift buyer trust & market growth.

What Are the Latest Trends in the Salmon Market?

The EU tops the global salmon market with 46.3% in 2024. This lead comes from high eat rates, old fish farm ways, & strong sell nets. Places like Norway & Scotland are key, adding to the market share. Also, the EU's push for green farm ways & OKs like MSC & ASC lift buyer trust & market growth.

Who Are the Key Players in the Salmon Market?

Cermaq Group, Lerøy Seafood Group ASA, Mowi ASA, and SalMar ASA, etc.

If you require any specific information that is not currently covered within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, considerations studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.