The India intravenous solutions market is a critical sector within the healthcare industry, valued at INR 171.44 billion in 2023. The market’s growth trajectory is supported by its widespread use in medical procedures such as surgery, post-surgical recovery, and managing chronic conditions. This article delves into the market’s segments, key players, market outlook, trends, and more, providing comprehensive insights into the industry.

Market Overview

Intravenous solutions are primarily used in hospitals and clinical settings for the administration of fluids, medications, and nutrients directly into a patient’s vein. These solutions play a pivotal role in ensuring patient hydration, managing electrolytes, delivering drugs, and maintaining vital body functions, especially in emergency, surgical, and critical care scenarios.

In India, the intravenous solutions market is poised for rapid growth, driven by factors like an ageing population, increasing hospital admissions, a rising burden of chronic diseases, and improvements in healthcare infrastructure. The India intravenous solutions market size was valued at INR 171.44 billion in 2023, and it is expected to grow at a compound annual growth rate (CAGR) of 8.3% during the forecast period of 2024-2032. By the end of 2032, the market is anticipated to reach INR 351.37 billion.

Key Drivers of Market Growth

- Rising Healthcare Needs: The growing number of surgical procedures, especially among the elderly and those with chronic diseases like diabetes, cardiovascular diseases, and cancer, has increased the demand for intravenous solutions. Additionally, the prevalence of dehydration, malnutrition, and electrolyte imbalances in India further fuels the market's expansion.

- Surge in Hospital Admissions: With the rising number of health conditions requiring hospitalisation, particularly due to infections, surgeries, and trauma care, there is an increasing demand for intravenous (IV) solutions to deliver essential fluids and medications.

- Technological Advancements: Innovations in IV solutions, including smart infusion systems and improved formulations, are revolutionising the industry. These advancements enhance the efficiency, precision, and safety of IV treatments, further boosting the market.

- Government Initiatives and Healthcare Investments: The Indian government’s increased investment in healthcare infrastructure, such as new hospitals, clinics, and healthcare programs, is expected to further boost the adoption of intravenous solutions. Additionally, government-backed healthcare schemes and insurance programs contribute to this growth.

Get a Free Sample Report with Table of Contents: https://www.expertmarketresearch.com/reports/india-intravenous-solutions-market/requestsample

Impact of COVID-19 on the Market

The COVID-19 pandemic had a significant impact on the healthcare sector worldwide, and the intravenous solutions market was no exception. On one hand, the pandemic led to a surge in demand for intravenous solutions, particularly in the management of critically ill COVID-19 patients who required intravenous hydration, medication, and electrolytes.

On the other hand, supply chain disruptions, manufacturing delays, and a temporary reduction in elective surgeries affected the market in the initial phase of the pandemic. However, with the subsequent recovery and increased focus on strengthening healthcare infrastructure, the market rebounded, and the demand for intravenous solutions surged in response to a rising number of post-COVID-19 care cases.

Market Segmentation

The intravenous solutions market in India can be segmented based on product type, application, and end user.

1. Product Type

- Crystalloids: These are the most commonly used IV solutions, typically used for hydration and fluid balance. They include saline, Ringer’s lactate, and dextrose solutions.

- Colloids: These solutions, including albumin and dextran, are used for volume replacement in cases of shock or significant fluid loss. They are less commonly used than crystalloids but are essential in critical care.

- Total Parenteral Nutrition (TPN): TPN solutions are used to provide nutrition to patients who cannot take food orally or through enteral feeding. This segment is gaining prominence due to its application in critical care and cancer treatments.

2. Application

- Surgical Care: The use of intravenous solutions during and post-surgery is the largest segment. They are required to maintain fluid balance and deliver drugs during anaesthesia.

- Emergency Care: IV solutions are indispensable in emergency care settings, especially for trauma and accident victims who need immediate rehydration or resuscitation.

- Chronic Diseases Management: IV solutions are used in the long-term management of conditions like cancer, diabetes, and kidney disease, requiring regular administration of fluids and electrolytes.

3. End User

- Hospitals: Hospitals remain the largest end users of intravenous solutions, accounting for the majority of market share due to the high demand for surgeries and critical care.

- Clinics: Clinics, especially those in rural areas, are increasingly adopting intravenous solutions for patient hydration and intravenous medication administration.

- Home Care Settings: With the rise of home care and telemedicine, home healthcare providers are using IV solutions for patients who require long-term intravenous treatments outside the hospital.

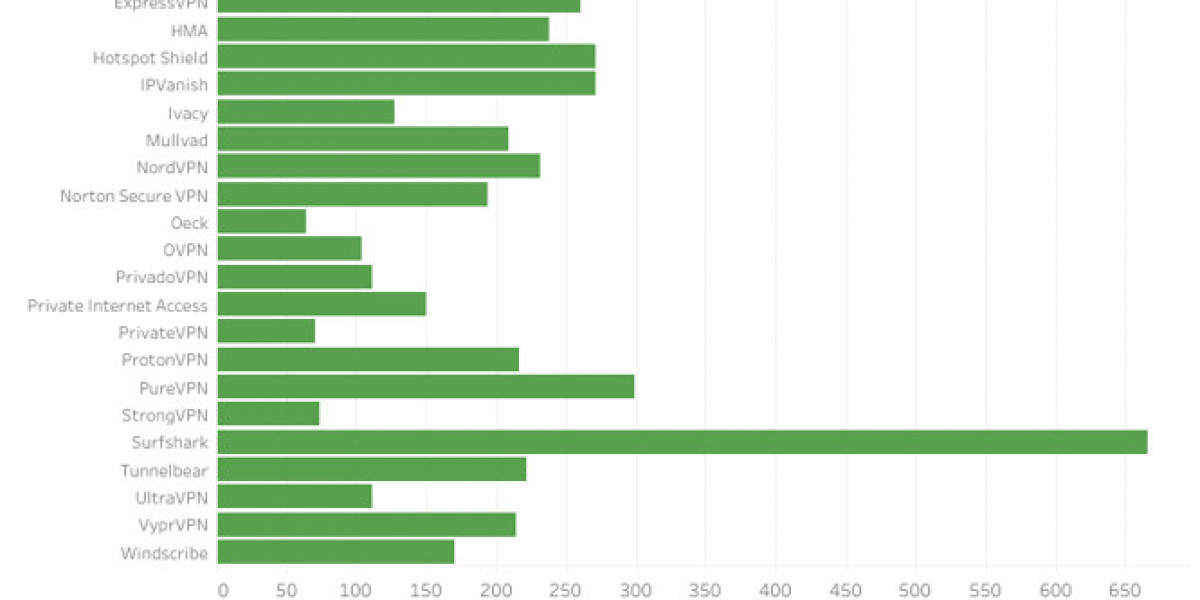

Key Players in the Market

Several leading companies are contributing to the growth of the intravenous solutions market in India. These key players include:

- Baxter Healthcare: Based in Deerfield, Illinois, Baxter is a global leader in the manufacture of intravenous fluids and related infusion devices. The company has a strong presence in India, providing critical care products like IV solutions, parenteral nutrition, and dialysis solutions.

- Pfizer Inc.: Headquartered in New York, Pfizer manufactures a wide range of IV products, including antibiotics, parenteral nutrition, and electrolyte solutions. Its focus on innovative drug delivery systems has contributed to its market share in India.

- Sodium Lab: Known for its expertise in the manufacturing of intravenous solutions and related products, Sodium Lab has expanded its reach in India, catering to the growing demand in healthcare facilities.

- Dr. Reddy’s Laboratories: Based in Hyderabad, Dr. Reddy’s Laboratories is involved in the production of a range of IV fluids used for hydration and critical care applications. Their solutions are widely distributed across hospitals and clinics in India.

- Clinova: Clinova, a key player in the Indian market, focuses on producing sterile and ready-to-use IV fluids that meet high-quality standards. The company’s portfolio includes saline and glucose-based solutions.

Market Trends

- Growing Preference for Single-Use IV Bags: With increasing awareness about infection control and reducing the risk of cross-contamination, single-use IV bags are becoming the preferred choice for healthcare providers.

- Rise in Home Healthcare: As home healthcare services gain momentum in India, there is a growing demand for intravenous solutions that can be administered at home, particularly for patients with chronic conditions who require long-term care.

- Focus on Packaging Innovations: Advances in packaging, such as the introduction of pre-filled IV bags and auto-infusers, are transforming the delivery and safety of intravenous solutions, contributing to the market’s growth.

- Emerging Role of Nutritional IV Therapy: With the rising popularity of personalised medicine and wellness treatments, nutritional intravenous therapy has gained attention, especially for patients with nutritional deficiencies, dehydration, and fatigue.

Market Outlook

The outlook for the India intravenous solutions market is highly positive. The increasing burden of diseases requiring IV treatment, coupled with advancements in healthcare infrastructure, indicates a sustained demand for intravenous solutions. The market is set to grow at a CAGR of 8.3% from 2024 to 2032, with the market value rising from INR 185.67 billion in 2024 to INR 351.37 billion by 2032.

Government initiatives to improve healthcare access in rural and underserved areas, along with rising investments in private healthcare facilities, are likely to further drive the adoption of intravenous solutions.

Frequently Asked Questions (FAQs)

1. What are intravenous solutions used for?

Intravenous solutions are used for fluid replacement, administering medications, hydration, and delivering essential nutrients directly into the bloodstream.

2. What is the growth rate of the intravenous solutions market in India?

The market is expected to grow at a CAGR of 8.3% from 2024 to 2032.

3. What are the key types of intravenous solutions?

The key types of intravenous solutions are crystalloids, colloids, and total parenteral nutrition (TPN).

4. Who are the key players in the intravenous solutions market in India?

Key players include Baxter Healthcare, Pfizer, Sodium Lab, Dr. Reddy’s Laboratories, and Clinova.

5. How did COVID-19 impact the intravenous solutions market?

COVID-19 led to an increased demand for intravenous solutions due to the critical care required for COVID-19 patients. However, it also caused initial supply chain disruptions, which later recovered as healthcare services adapted.

6. What is the future outlook for the intravenous solutions market in India?

The future outlook is positive, with the market expected to grow significantly due to increasing healthcare needs, technological advancements, and rising healthcare investments.

Related Trending Reports