Customs clearance software revolutionizes the way businesses manage their import and export processes. By automating documentation and compliance checks, it greatly reduces the risk of delays and fines. Implementing this technology can streamline customs clearances, making the process faster and more efficient for companies of all sizes.

In today's global marketplace, timely and accurate customs clearance is essential for maintaining a competitive edge. Manual processes can lead to errors and significant hold-ups. With the rise of customs clearance software, companies can enhance their operational efficiency, ensuring compliance with regulations and improving shipment transparency.

Investing in the right customs clearance software can transform logistics operations. It not only simplifies the complexities of international trade but also enhances communication between stakeholders. This advancement ultimately supports businesses in delivering their products on time and maintaining customer satisfaction.

Core Features and Functionality

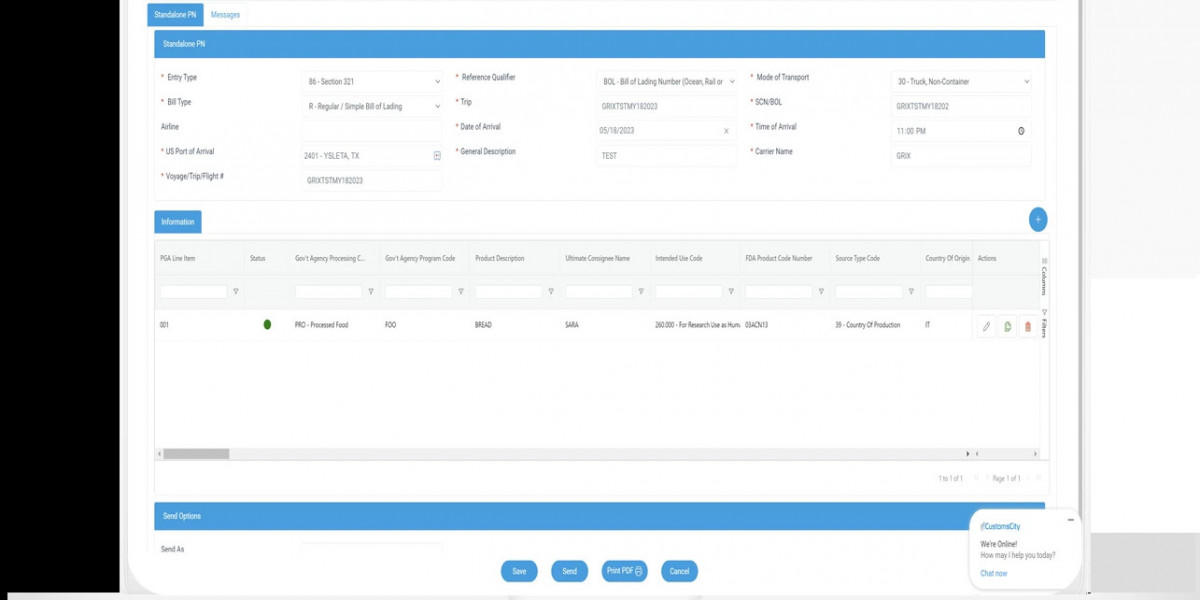

Customs clearance software contains several essential features that enhance efficiency and ensure compliance in the customs process. Key functionalities include compliance management, data integration, automated document handling, and risk assessment, which are crucial for optimizing operations and maintaining regulatory adherence.

Compliance Management Tools

Compliance management tools are designed to assist in navigating the complex regulations governing international trade. These tools help users stay updated on customs laws and trade agreements across various jurisdictions.

Functions often include:

- Automated Updates: Regular updates about changing regulations, avoiding compliance risks.

- Audit Trails: Maintaining records for auditing purposes, enhancing transparency.

- Checklists: Providing standardized procedures to ensure all necessary documentation is submitted.

Effective compliance tools reduce the risk of penalties and facilitate smoother transactions across borders.

Data Integration and Management

Data integration and management features streamline the exchange of information between various stakeholders in the customs process.

Customs clearance software typically enables:

- Real-Time Data Sharing: Facilitating seamless communication between importers, exporters, and customs authorities.

- Centralized Database: Storing all relevant documents and data in one location for easy access.

- APIs: Integration with other systems like ERP and accounting, ensuring consistency across platforms.

This functionality minimizes errors and provides a comprehensive view of shipments, improving decision-making.

Automated Document Handling

Automated document handling is a crucial function that saves time and reduces manual errors. This feature automates the generation, tracking, and submission of essential customs documents.

Key functionalities include:

- Template Creation: Preparing customizable templates for various customs documents.

- Auto-Submission: Automatically sending documents to customs authorities, reducing delays.

- Tracking Capabilities: Monitoring the status of submitted documents to ensure timely processing.

By automating these tasks, organizations can enhance accuracy and efficiency in their customs procedures.

Risk Assessment and Management

Risk assessment and management features help identify potential compliance risks and operational inefficiencies. These tools allow organizations to preemptively address issues that could lead to delays or penalties.

Core components include:

- Risk Scoring Systems: Evaluating shipments based on historical data and customs profiles.

- Alerts and Notifications: Informing users about potential risks or compliance lapses.

- Mitigation Strategies: Providing best practices to reduce identified risks.

By effectively managing risks, businesses can foster smoother customs operations and uphold their reputation in international trade.

Customs Clearances Explained

Customs clearances involve the approval process required for goods entering or leaving a country. Understanding the associated regulations, the involvement of customs brokers, and the necessary documentation is crucial for smooth transactions.

Understanding Customs Regulations

Customs regulations vary by country and govern how goods are imported and exported. Compliance is essential to avoid delays and legal penalties. Each nation has its own rules regarding tariffs, duties, and prohibited items.

Businesses must familiarize themselves with these regulations to ensure compliance. Regular updates from customs authorities help companies stay informed about changes. Failure to comply can result in fines or confiscation of goods.

Additionally, customs regulations may require specific licenses for certain goods. This includes items subject to import restrictions or health regulations, such as pharmaceuticals or agricultural products.

The Role of Customs Brokers

Customs brokers act as intermediaries between importers/exporters and customs authorities. Their primary function is to facilitate the customs clearance process, ensuring that all necessary documentation is submitted accurately and on time.

They possess specialized knowledge of customs regulations and can provide valuable advice. By navigating complex legal requirements, customs brokers help businesses avoid potential pitfalls and streamline operations.

Fees for customs broker services vary, but the investment can lead to significant savings in time and potential penalties. Many businesses find that partnering with a knowledgeable broker alleviates the stress associated with compliance.

Import/Export Documentation Requirements

Proper documentation is vital for successful customs clearances. Key documents typically include the commercial invoice, bill of lading, and packing list. Each document serves a specific purpose and must be completed accurately.

- Commercial Invoice: Details the transaction, including descriptions, quantities, and value of goods.

- Bill of Lading: Serves as a contract between the shipper and carrier, outlining the shipment’s journey.

- Packing List: Lists all items within a shipment, assisting customs officers in verifying contents.

Additional documents may be required depending on the goods involved, such as certificates of origin or import permits. Ensuring the correctness and completeness of this documentation minimizes the risk of delays during the customs clearance process.