Summary:

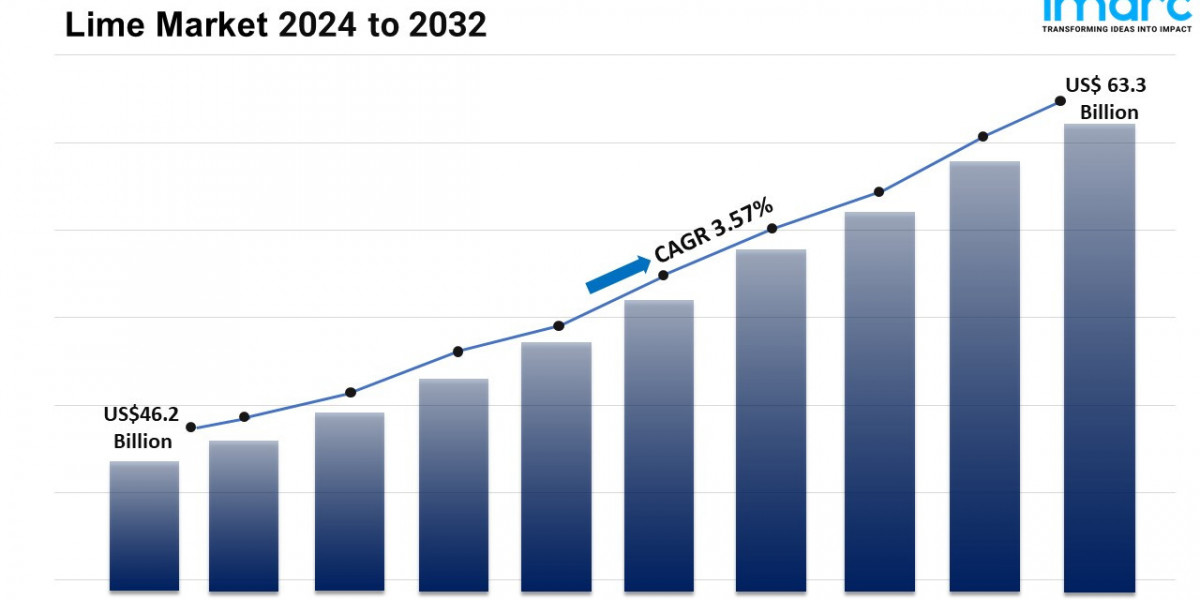

- The global lime market size reached USD 46.2 Billion in 2023.

- The market is expected to reach USD 63.3 Billion by 2032, exhibiting a growth rate (CAGR) of 3.57% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest lime market share.

- Quick lime accounts for the majority of the market share in the product type segment due to its extensive use in construction, steel manufacturing, and environmental applications, where its reactivity and versatility are especially valued.

- Building material holds the largest share in the lime industry.

- The increasing demand for lime in environmental applications is a primary driver of the lime market.

- The lime market growth and forecast highlight a significant rise due to increasing use of lime in the construction industry.

Industry Trends and Drivers:

- Growing Demand for Lime in Environmental Applications:

The industry is experiencing several lime market trends such as a significant increase in demand for environmental applications, as lime plays a critical role in pollution control and waste treatment. Lime is commonly used in flue gas desulfurization (FGD) systems to remove sulfur dioxide (SO₂) from exhaust gases in industries such as power generation, cement manufacturing, and chemical processing. Additionally, lime is essential for water treatment, where it helps adjust pH levels, remove impurities, and neutralize acidic waste. With growing regulatory pressure and environmental awareness, industries are increasingly adopting cleaner processes, making lime a vital component in reducing emissions and improving waste management. The increased focus on sustainable practices has led to a rise in demand for lime in environmental applications, particularly in emerging markets where industrialization is accelerating. The expansion of wastewater treatment plants and air quality control measures worldwide is further propelling this trend. As regulations continue to tighten and industries adopt greener practices, the lime demand is expected to grow.

- Rising Usage of Lime in the Construction Industry:

The construction industry remains one of the largest consumers of lime, driven by its essential role in producing building materials like cement, plaster, and mortar, that is primarily responsible for the expansion of lime market share. Lime's chemical properties make it a valuable additive for enhancing the durability and workability of construction materials. With the surge in global infrastructure projects, particularly in fast-growing regions like Asia Pacific and the Middle East, the demand for lime in construction is on the rise. Lime is also used for soil stabilization in road construction, as it helps improve soil strength and longevity, reducing maintenance needs. Additionally, as construction companies focus on sustainable building practices, lime is gaining traction for its low environmental impact compared to other additives. Renovation and restoration projects are another growth area, with lime-based materials being preferred for historic building preservation due to their compatibility with traditional construction methods. With increased investments in infrastructure and real estate, the construction industry’s demand for lime is set to remain robust, reinforcing its importance as a key material in building and development.

- Technological Advancements in Lime Production:

Technological advancements in lime production are transforming the lime market, with a focus on improving efficiency, reducing costs, and minimizing environmental impact. Innovations such as advanced kiln designs, automated process controls, and energy-efficient calcination methods are enhancing the production process, allowing manufacturers to produce high-quality lime more sustainably. Modern kilns, for example, are designed to optimize heat distribution, leading to higher output and reduced energy consumption. Additionally, automation and digital monitoring systems are enabling real-time control over production variables, ensuring consistent quality and reducing waste. These technologies also support carbon capture and storage (CCS) systems, which help mitigate carbon emissions associated with lime production. The adoption of these sustainable technologies aligns with global efforts to reduce greenhouse gas emissions, as lime production is traditionally an energy-intensive process. As demand for lime grows across industries, manufacturers are increasingly investing in technology to meet both production and environmental standards. This trend toward technological innovation is expected to drive efficiency in the lime industry while supporting environmental goals, expanding the lime market size.

Request Sample For PDF Report: https://www.imarcgroup.com/lime-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

- Quick Lime

- Hydrated Lime

Quick lime accounts for the majority of shares due to its widespread use in construction, steel manufacturing, and environmental applications, where its reactivity and versatility are highly valued.

Breakup by Application:

- Agriculture

- Building Material

- Mining and Metallurgy

- Water Treatment

- Others

Building material exhibits a clear dominance as lime is a key component in cement, plaster, and mortar production, making it essential for construction and infrastructure development.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific’s dominance in the lime market is attributed to rapid industrialization, extensive construction activities, and growing infrastructure development in countries like China and India, which significantly drive lime consumption.

Top Lime Market Leaders:

- Afrimat

- Boral Limited

- Carmeuse

- Cheney Lime & Cement Company

- Cornish Lime

- Graymont Limited

- Lhoist Group

- Minerals Technologies Inc.

- Mississippi Lime Company

- Nordkalk Corporation (SigmaRoc plc)

- Pete Lien & Sons Inc.

- Sigma Minerals Limited

- United States Lime & Minerals Inc.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.