Introduction

The VA Loan Program stands as one of the most valuable benefits available to U.S. veterans, active-duty service members, and their families. This government-backed mortgage program not only offers a pathway to affordable homeownership but also comes with a host of financial advantages that can significantly reduce the costs of purchasing a home. In this comprehensive guide, we will explore the ins and outs of VA loans, breaking down the key benefits, eligibility requirements, and strategies for maximizing the full potential of this remarkable financing option.

What is a VA Loan?

A VA loan is a mortgage loan issued by private lenders, such as banks or credit unions, but guaranteed by the U.S. Department of Veterans Affairs (VA). This government backing allows lenders to provide more favorable terms and offers veterans the opportunity to purchase homes with fewer financial barriers.

Key Features of VA Loans:

- No down payment required (for most loans).

- No private mortgage insurance (PMI).

- Competitive interest rates.

- Easier qualification standards compared to conventional loans.

- Limited closing costs.

- Assumable loans, meaning the loan can be transferred to another buyer under certain conditions.

Top Benefits of VA Loans

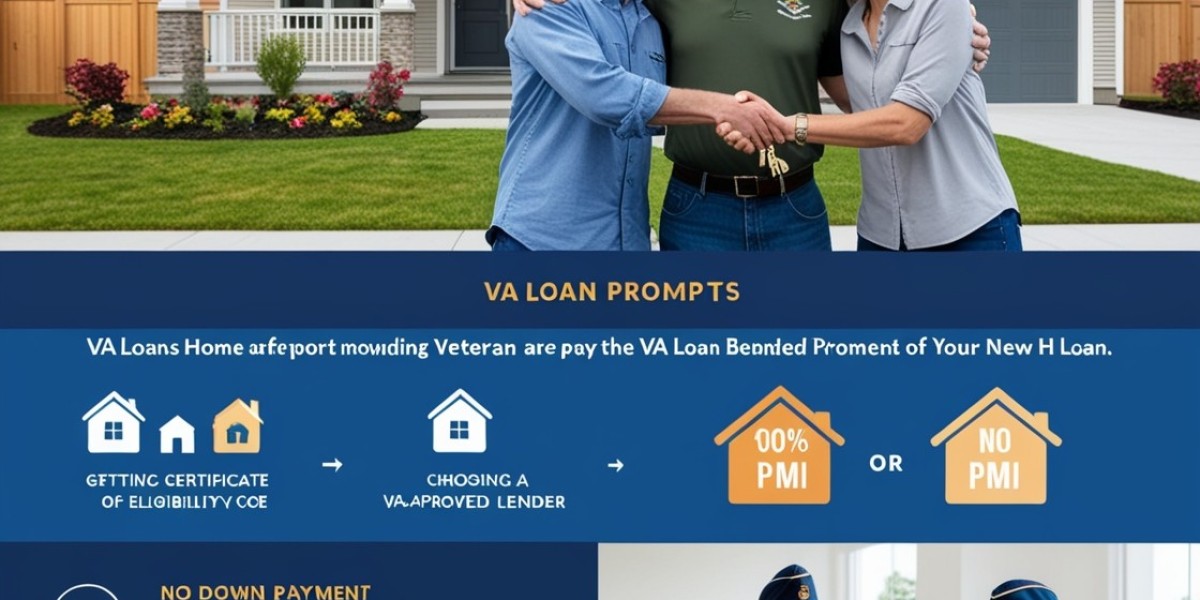

1. No Down Payment

One of the most attractive benefits of a VA loan is the ability to purchase a home without making a down payment. In contrast to conventional loans that often require a 5-20% down payment, VA loans allow eligible borrowers to finance the entire purchase price of the home.

- Benefit: By eliminating the need for a down payment, veterans can save tens of thousands of dollars upfront, making homeownership a more immediate possibility.

2. No Private Mortgage Insurance (PMI)

In conventional mortgage loans, borrowers who put down less than 20% of the home’s purchase price are usually required to pay for private mortgage insurance (PMI). VA loans do not require PMI, regardless of the loan-to-value ratio.

- Benefit: Not having to pay PMI can reduce monthly mortgage payments significantly, saving veterans hundreds, if not thousands, of dollars over the life of the loan.

3. Competitive Interest Rates

Due to the government guarantee, lenders face less risk when issuing VA loans. As a result, VA loans often come with lower interest rates compared to conventional or FHA loans.

- Benefit: Lower interest rates can translate into substantial savings on monthly payments and overall interest paid over the loan term.

4. Flexible Credit Requirements

While credit scores are still considered in VA loan applications, the VA loan program tends to be more lenient than conventional loan programs. Most lenders require a minimum credit score of 620, but some may approve loans for those with lower scores, depending on the overall financial picture.

- Benefit: Veterans with less-than-perfect credit histories can still qualify for favorable mortgage terms, making homeownership more accessible.

5. Limited Closing Costs

The VA limits the closing costs that lenders can charge to veterans, helping to reduce the upfront expenses associated with purchasing a home. Additionally, sellers are permitted to cover some of these costs, easing the financial burden on buyers.

- Benefit: Lower closing costs mean less out-of-pocket expenses at the time of closing, allowing veterans to keep more money in their pockets.

6. Loan Assumption

VA loans are assumable, meaning that if you sell your home, the buyer can take over your VA loan, assuming they meet the qualifications. This can be a particularly appealing feature in a rising interest rate environment.

- Benefit: Assumable loans can make your home more attractive to potential buyers, especially if your existing mortgage has a lower interest rate than what’s currently available.

Eligibility for VA Loans

To qualify for a VA loan, you must meet certain service requirements. These include:

1. Service Requirements

- Active-duty service members and veterans must have served a minimum of 90 continuous days during wartime or 181 days during peacetime.

- National Guard members and reservists may be eligible after serving six years.

- Certain surviving spouses of veterans may also qualify for VA loan benefits.

2. Certificate of Eligibility (COE)

To access a VA loan, you must obtain a Certificate of Eligibility (COE), which confirms your service history and verifies your eligibility for the loan. You can apply for a COE through the VA’s online portal, by mail, or through your lender.

3. Other Eligibility Factors

Beyond service requirements, lenders will also consider other financial factors when evaluating your application, such as your credit score, debt-to-income ratio, and income stability.

How to Apply for a VA Loan

Step 1: Get Pre-Approved

Before you start shopping for a home, it's important to get pre-approved for a VA loan. Pre-approval will give you an estimate of how much you can borrow and demonstrate to sellers that you are a serious buyer.

Step 2: Obtain Your Certificate of Eligibility (COE)

Work with your lender to secure your COE, which is required to verify your eligibility for the VA loan program.

Step 3: Choose a VA-Approved Lender

Not all lenders offer VA loans, so it's essential to choose a lender who is experienced in handling VA loan applications and can guide you through the process smoothly.

Step 4: Complete Your Loan Application

Once you’ve found a VA-approved lender and a home, you can proceed with submitting your full loan application. Be prepared to provide documentation such as proof of income, bank statements, and any other financial records requested by your lender.

Step 5: VA Appraisal and Underwriting

The VA will require an appraisal to ensure that the property meets its standards and is priced fairly. After the appraisal, the lender will finalize the underwriting process to determine if you're approved for the loan.

Step 6: Close on Your Loan

If everything goes smoothly, you’ll be ready to close on your new home. During the closing process, you’ll sign all necessary documents and officially become a homeowner.

VA Loan Funding Fee

While VA loans offer numerous benefits, there is a one-time VA funding fee that helps cover the cost of the program for taxpayers. This fee can vary based on factors such as your down payment amount and whether it’s your first time using the VA loan benefit.

- Tip: Some veterans, especially those with service-related disabilities, may be exempt from the VA funding fee. Be sure to check your eligibility for any exemptions before closing on your loan.

Maximizing Your VA Loan Benefits

To get the most out of your VA loan benefits, consider the following strategies:

- Shop around for lenders: VA loan terms can vary from lender to lender, so it’s essential to compare offers and choose one that provides the best rates and lowest fees.

- Take advantage of the no-down-payment option: If you're a first-time homebuyer or want to preserve your savings, leverage the ability to purchase with no down payment.

- Look into refinancing options: The VA offers Interest Rate Reduction Refinance Loans (IRRRLs), which allow veterans to refinance to a lower interest rate.

- Understand your exemption options: If you're eligible for a funding fee exemption, be sure to confirm this before you apply, as it can save you thousands of dollars.

Conclusion

The VA Loan Program offers a wealth of benefits that can make homeownership a reality for veterans and their families. With features like no down payment, no PMI, competitive interest rates, and flexible credit standards, VA loans are designed to provide financial relief and ease the home buying process for those who have served. By fully understanding and maximizing the advantages of this program, veterans can achieve their dream of homeownership while saving money and securing a stable future.