Summary:

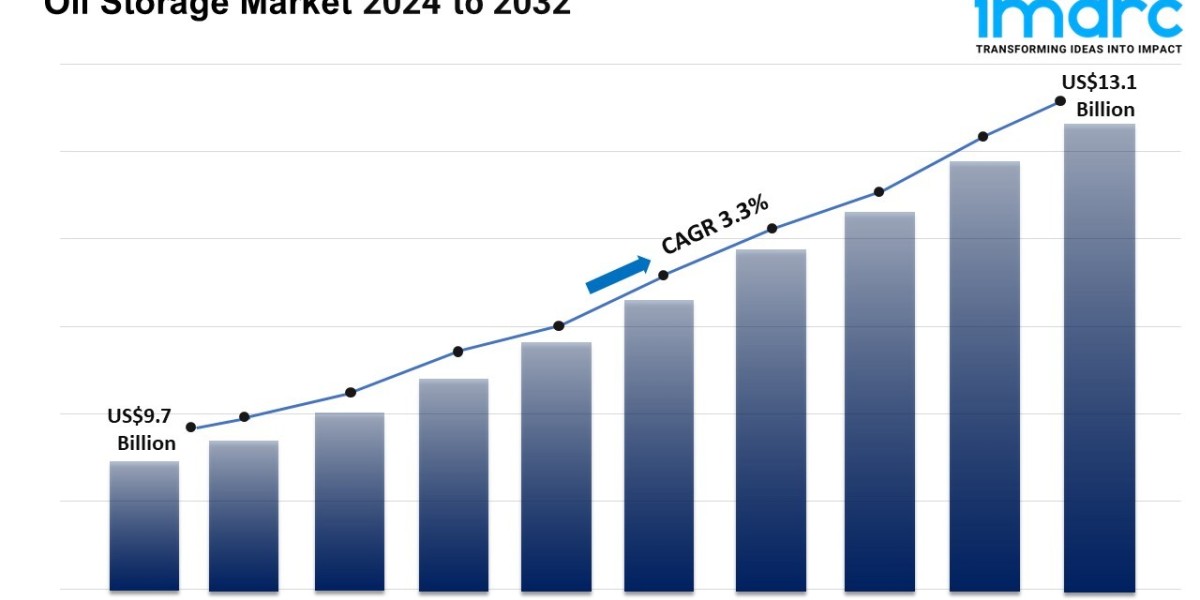

- The global oil storage market size reached USD 9.7 Billion in 2023.

- The market is expected to reach USD 13.1 Billion by 2032, exhibiting a growth rate (CAGR) of 3.3% during 2024-2032.

- Middle East and Africa leads the market, accounting for the largest oil storage market share.

- Carbon steel accounts for the majority of the market share in the material segment due to its strength and affordability in oil storage applications.

- Floating roof tanks hold the largest share in the oil storage industry.

- Crude oil remains a dominant segment in the market due to the significant global demand for its storage.

- The growing need for strategic petroleum reserves (SPR) is a primary driver of the oil storage market.

- The growing investments in floating roof tanks is propelling the oil storage market.

Industry Trends and Drivers:

- Rising Demand for Strategic Petroleum Reserves (SPR):

The increasing focus on energy security has led to the expansion of Strategic Petroleum Reserves (SPR) by various countries, driving the oil storage market. Governments around the world are building and expanding their petroleum reserves to safeguard against supply disruptions, price volatility, and geopolitical uncertainties. Countries like the United States, China, and India have been leading in the development of large-scale oil storage facilities to meet growing demand and strengthen their energy security. With the fluctuating global oil prices and growing concerns over supply shortages, nations are investing heavily in storage infrastructure to store crude oil during times of surplus. This trend has been particularly prominent in Asia-Pacific, where rapid industrialization and energy demand have heightened the need for secure oil supplies. The development of new storage terminals and expansion of existing ones will continue to fuel growth in the oil storage market.

- Increasing Investments in Floating Roof Tanks:

Floating roof tanks are gaining popularity in the oil storage industry due to their ability to reduce evaporation losses and enhance storage efficiency. These tanks are designed with a floating roof that moves with the level of the stored liquid, minimizing the vapor space above the oil, thereby reducing the risk of vapor emissions and product loss. As environmental regulations tighten and the demand for environmentally friendly storage solutions grows, many oil storage companies are investing in floating roof tanks. This type of storage system enhances storage capacity and contributes to reducing greenhouse gas emissions by curbing volatile organic compounds (VOCs) that would otherwise be released into the atmosphere. The adoption of floating roof tanks is particularly noticeable in regions with stringent environmental policies, such as North America and Europe. As a result, floating roof tank technology is expected to see significant growth in the coming years, driven by both operational and environmental benefits.

- Technological Advancements in Digital Oil Storage Solutions:

The oil storage industry is witnessing a shift toward digitalization as companies adopt advanced technologies to improve operational efficiency and safety. Digital oil storage solutions, such as real-time monitoring systems, automated valves, and predictive maintenance tools, are transforming the way storage facilities operate. These technologies enable operators to monitor oil levels, detect leaks, and manage inventory more efficiently, reducing downtime and minimizing risks. The integration of artificial intelligence (AI) and the Internet of Things (IoT) into storage infrastructure allows for real-time data analysis, optimizing storage capacity and preventing accidents. Additionally, predictive analytics can forecast equipment failures before they occur, enabling timely maintenance and avoiding costly disruptions. As the industry moves toward more automated and intelligent systems, digital oil storage solutions are expected to play a crucial role in enhancing operational efficiency and reducing operational costs. This trend is particularly evident in technologically advanced regions like North America and Europe, where oil storage operators are leading the digital transformation.

Request Sample For PDF Report: https://www.imarcgroup.com/oil-storage-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

Breakup by Material:

- Steel

- Carbon Steel

- Fiberglass Reinforced Plastic (FRP)

- Others

Carbon steel accounts for the majority of shares due to its durability and cost-effectiveness in oil storage.

Breakup by Product:

- Open Top

- Fixed Roof

- Floating Roof

- Others

Floating roof tanks dominate the market as they minimize evaporation and product loss.

Breakup by Application:

- Crude Oil

- Middle Distillates

- Gasoline

- Aviation Fuel

- Others

Crude oil exhibits a clear dominance due to its high storage demand globally.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Middle East and Africa holds the leading position owing to a large market for oil storage driven by their vast oil production and strategic storage needs.

Top Oil Storage Market Leaders:

- Buckeye Partners L.P.

- CST Industries Inc.

- Denali Incorporated (National Oilwell Varco Inc.)

- Energy Transfer LP

- L.F. Manufacturing

- Oiltanking GmbH (Marquard & Bahls)

- Royal Vopak N.V.

- Shawcor Ltd.

- Synalloy Corporation

- Snyder Industries LLC

- VTTI B.V.

- Ziemann Holvrieka GmbH

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.