views

Esters Market Size, Global Industry Outlook & Forecast Analysis to 2032

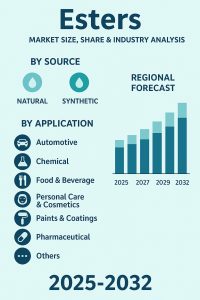

According to Fortune Business Insights, The global esters market was valued at USD 8.54 billion in 2024 and is anticipated to expand from USD 8.90 billion in 2025 to USD 13.15 billion by 2032, reflecting a CAGR of 5.5% over the forecast period. In 2024, Asia Pacific emerged as the leading region, accounting for 45.55% of the overall market share.

Esters are organic compounds formed through the reaction of acids and alcohols, in which a hydroxyl group is replaced by an alkoxy group. Owing to their unique fragrances, solubility, and chemical adaptability, esters find applications across a wide range of industries. They serve as essential ingredients in the production of solvents, plasticizers, synthetic flavors, fragrances, and biodiesel, making them highly valuable in both industrial and commercial processes. The esters market has been gaining significant momentum in recent years, driven by its wide applications across industries such as lubricants, paints and coatings, plastics, personal care, and food and beverages. Esters are chemical compounds derived from acids and alcohols, offering beneficial properties such as biodegradability, high thermal stability, low volatility, and eco-friendliness, making them increasingly important in sustainable industrial practices.

The global esters market is projected to witness strong growth, supported by rising demand for environmentally friendly lubricants, the expansion of the personal care industry, and the adoption of advanced materials in packaging and coatings. Rapid industrialization, coupled with increasing awareness of green chemistry solutions, is also contributing to the market’s expansion.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/esters-market-113697

LIST OF KEY ESTERS COMPANIES

- Mitsubishi Chemical Group Corporation (Japan)

- Esters and Solvents LLP (India)

- Croda International Plc. (U.K.)

- BASF SE (Germany)

- Estelle Chemicals Pvt. Ltd. (India)

- Exxon Mobil Corporation (U.S.)

- The Dow Chemical Company (U.S.)

- Arkema (France)

- Solvay (Belgium)

- Evonik Industries AG (Germany)

Key Market Drivers

-

Growing Demand in Lubricants

Esters are extensively used as synthetic lubricants due to their superior lubrication properties, high flash point, and biodegradability. With industries shifting toward sustainable alternatives, demand for ester-based lubricants in automotive, aerospace, and industrial applications is growing. -

Rising Applications in Personal Care & Cosmetics

Esters serve as emollients, solvents, and dispersing agents in cosmetics and personal care products. Increasing consumer demand for natural and organic beauty products is pushing manufacturers to use bio-based esters. -

Booming Paints and Coatings Industry

In paints, coatings, and inks, esters function as solvents that enhance viscosity and drying properties. The rapid growth of construction and automotive industries is directly fueling this demand. -

Shift Toward Biodegradable Plastics

Esters are essential in producing biodegradable polymers and plasticizers, which are gaining traction as governments tighten regulations on single-use plastics.

Market Segmentation

-

By Type:

-

Methyl Esters

-

Polyol Esters

-

Phosphate Esters

-

Nitrate Esters

-

Others

-

-

By Application:

-

Lubricants

-

Paints & Coatings

-

Plastics & Polymers

-

Food & Beverages (as flavoring agents)

-

Personal Care & Cosmetics

-

-

By Region:

-

North America: Strong demand in synthetic lubricants and coatings.

-

Europe: Driven by environmental regulations and adoption of green chemistry.

-

Asia-Pacific: Fastest-growing market, led by China and India due to industrial growth and rising disposable income.

-

Latin America & Middle East: Expanding automotive and construction industries boosting ester consumption.

-

Market Trends

-

Bio-based Esters: Increasing adoption of renewable and bio-based esters is a major trend as industries focus on reducing carbon footprints.

-

Technological Innovations: Companies are investing in R&D to produce high-performance esters tailored for niche applications like aerospace lubricants and specialty coatings.

-

Regulatory Support: Stringent government regulations favor biodegradable and low-VOC products, boosting ester demand.

Competitive Landscape

The esters market is moderately fragmented, with global players competing on the basis of product innovation, cost-efficiency, and sustainability. Major players are focusing on mergers, acquisitions, and capacity expansion to strengthen their market position.

The esters market is poised for steady growth over the next decade. Rising awareness of sustainable products, growth in end-use industries, and increasing adoption of bio-based solutions will be the primary drivers. By 2032, the market is expected to expand significantly, supported by global initiatives toward eco-friendly industrial practices.

Information Source: https://www.fortunebusinessinsights.com/esters-market-113697

KEY INDUSTRY DEVELOPMENTS

- March 2024: Mitsubishi Chemical Group announced the expansion of its Sugar Ester emulsifier production capacity by adding a new line at its Kyushu Plant in Japan. The new facility, with a capacity of 2,000 tons per year, has begun its full-scale operation in March 2024, while an additional line with a capacity of 1,100 tons per year is planned to start operations in March 2026.

- December 2023: Croda International Plc. opened a new facility, Pastillator 4 (PS04), at its Seraya site in Jurong Island, Singapore. With an investment of approximately USD 16 million, the expansion increased the site’s production capacity by 4.6 kilotons, bringing the total capacity to 15 kilotons, to serve the growing demand for pastille-format alkoxylates and esters.

Comments

0 comment