views

N-Propanol Market Expansion Forecast with Emerging Opportunities by 2032

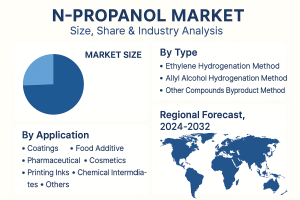

According to Fortune Business Insights, The global n-propanol market size was USD 1,613.1 million in 2023 and is projected to grow from USD 1,684.9 million in 2024 to USD 2,374.1 million in 2032 at a CAGR of 4.3% during the forecast period (2024-2032). Asia Pacific dominated the N-propanol market with a market share of 33.3% in 2023. Moreover, the n-propanol market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 634.0 million by 2032, driven by increasing demand for paints & coatings from the building & construction and automotive industries.

The increasing demand for paints & coatings from the building & construction and automotive industries is the primary factor driving market growth. The need for alcohol in emerging economies is projected to grow rapidly due to rising industrialization and urbanization activities.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/n-propanol-market-105137

LIST OF KEY COMPANIES PROFILED

- BASF (Germany)

- Dow (U.S.)

- Eastman (U.S.)

- Oxea (Germany)

- Sasol (South Africa)

- Wu Jiang Chemical (China)

- Nanjing Rongxin Chemical (China)

- Chang Chun Group (China)

- Ningbo Juhua Chemical (China)

- Zibo Nalcohol Chemical (China)

Market Segmentation

By Production Method

The ethylene-hydrogenation method dominates the market due to its better efficiency and yields. The allyl-alcohol hydrogenation and by-product routes are also expanding, particularly in the coatings and adhesive sectors.

By Application

Coatings and solvents (automotive and industrial paints, inks, adhesives) command a primary share, driven by packaging, construction, and textile inks.

Pharmaceuticals follow, using N-propanol as a high-purity solvent, antiseptic, intermediate, and excipient.

Cosmetics and personal care, food additives, and printing inks also represent significant growing segments.

By Product Grade and Purity

Pharmaceutical-grade accounted for approximately 35% of revenue in 2023. Industrial-grade is projected to grow fastest in the forecast period.

High-purity forms (99.5–99.99%) are increasingly demanded in electronics and semiconductor applications.

Regional Outlook

Asia-Pacific leads with over 45% global market share in 2023, supported by China and India’s expanding chemical, construction, pharmaceutical, and automotive industries. Growth rates in APAC are strong, with India showing a 14% rise in pharmaceuticals.

North America holds roughly 21% share, driven by U.S. demand in coatings, printing inks, specialty chemicals, and industrial cleaning.

Europe, with approximately 28% share, benefits from the demand for low-VOC and bio-based solvents, reinforced by REACH regulation and green chemistry policies.

MEA and Latin America are emerging markets, projected at around 6% share, supported by infrastructure investment in petrochemical diversification across regions such as the GCC, South Africa, and Brazil.

Key Growth Drivers

-

Industrial Demand: Widespread use in coatings, adhesives, inks, cleaners, and intermediates such as propylene oxide for polyurethane and plastics.

-

Pharmaceutical and Personal Care Expansion: Rising drug production and cosmetics formulations are driving solvent usage at high purity levels.

-

Sustainability Trends: Increasing shift to bio-based production routes of N-Propanol appeals to eco-conscious consumers and is supported by regulatory initiatives.

Restraints and Challenges

-

Stringent environmental regulations on VOC emissions and solvent handling limit use in conventional petro-based solvents.

-

Volatility in raw-material costs, such as acetone, propylene, and crude oil, can hamper profitability.

-

Competition from green alternatives like water-based coatings and bio-derived chemicals is increasingly strong.

Competitive Landscape and Recent Developments

Notable industry players include BASF SE, Dow, Eastman, Oxea, Sasol, Solvay, Dairen Chemical, and major Chinese producers like Nanjing Rongxin, Zibo Nalcohol, and Ningbo Juhua Chemical.

-

Oxea (Germany) tripled its European capacity in early 2023 to meet rising demand from hand sanitizer, printing, and coatings sectors.

- Ningbo Juhua Chemical (China) began operations at a new 50-kiloton plant in September 2023, boosting local and export capacity.

Outlook Summary

| Metric | Estimate / Trend |

|---|---|

| 2024 Market Size | USD 1,684.9 million |

| 2032 Forecast | USD 2,374.1 million |

| CAGR (2024–2032) | 4.3% |

| Leading Region | Asia-Pacific (33.3%) |

| Top Applications | Coatings, pharma, cosmetics |

| Key Growth Drivers | Industrial growth, sustainability, pharma expansion |

| Major Constraints | Regulation, raw-material volatility, green alternatives |

Strategic Implications

-

Invest in bio-based or renewable feedstock routes to align with sustainability incentives and regulatory trends.

-

Expand production footprint in Asia-Pacific, particularly in India and China.

-

Focus on specialty grades (≥99.5% purity) targeted at pharma and electronics markets.

-

Innovate low-VOC solvent blends or hybrid formulations to retain market share in strictly regulated regions like Europe and North America.

Despite moderate headwinds from regulation and raw material volatility, the N-Propanol market is poised for steady expansion—especially fueled by growing demands in coatings, pharmaceuticals, and eco-friendly manufacturing. Companies aligning with sustainability trends, targeting high-purity curations, and expanding in high-growth regions will likely capture the greatest opportunity in the coming decade.

Information Source: https://www.fortunebusinessinsights.com/n-propanol-market-105137

KEY INDUSTRY DEVELOPMENTS

- April 2023 - Oxea tripled its production capacity of 1-propanol in Europe. This is due to high demand from manufacturers of hand sanitizers and the printing industry. With this expansion, the company will be able to serve its customer requirements efficiently.

- September 2023- The 1-propanol plant of Ningbo Juhua Chemical was put into operation. This new plant has an annual capacity of 50 kilotons and will also produce products including propionaldehyde. Hence, this development will help the company to enter this market.

Comments

0 comment