views

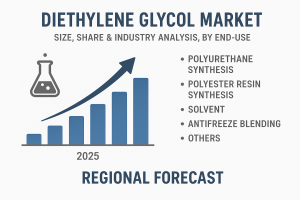

Diethylene Glycol Market Trends and Innovations in End-Use Industries 2025-2032

According to Fortune Business Insights, The global diethylene glycol market was valued at USD 5.0 billion in 2024 and is anticipated to expand from USD 5.2 billion in 2025 to USD 6.8 billion by 2032, registering a CAGR of 3.9% during the forecast period. In 2024, Asia Pacific led the market, accounting for 61.4% of the overall share. The Diethylene Glycol (DEG) market is gaining momentum across various industries due to its versatile applications in resins, polyurethanes, plasticizers, coolants, and lubricants. DEG, a clear, hygroscopic, and odorless liquid, is primarily produced as a byproduct of ethylene oxide hydrolysis. Its demand is strongly influenced by the growth of construction, automotive, and textile industries, which are major consumers of resins and polyurethanes.

The global Diethylene Glycol market is projected to witness significant growth between 2025 and 2032, driven by rising consumption in coatings, adhesives, and plastics manufacturing. Additionally, DEG is widely used as a solvent and chemical intermediate, which enhances its importance in chemical processing.

List of Key Diethylene Glycol Players Profiled

- Mitsubishi Chemical Group Corporation (Japan)

- Reliance Industries Limited (India)

- Shell (U.K.)

- SABIC (Saudi Arabia)

- NIPPON SHOKUBAI CO., LTD. (Japan)

- BASF (Germany)

- China Petrochemical Corporation (Sinopec) (China)

- PETRONAS (Malaysia)

- MEGlobal (Kuwait)

- Junsei Chemical Co., Ltd. (Japan)

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/diethylene-glycol-market-113453

Key drivers include:

-

Expanding polyurethane and polyester resin industries.

-

Rising demand in construction, automotive, and packaging sectors.

-

Increasing application in unsaturated polyester resins (UPR) for reinforced plastics.

-

Widening use as a dehydrating agent in natural gas processing.

However, health hazards and toxicity concerns associated with DEG, along with strict regulatory guidelines, may hinder market expansion.

Diethylene Glycol (DEG) is a versatile, colorless, odorless, and water-soluble organic compound extensively utilized as a solvent, plasticizer, and chemical intermediate. One of the primary growth drivers for DEG is the expanding global polyester industry, where it plays a vital role in the production of unsaturated polyester resins used in coatings, adhesives, and composite materials.

With industries such as packaging, construction, and automotive increasingly adopting polyester-based products, the demand for DEG continues to accelerate. Beyond polyester applications, DEG is also widely employed in brake fluids, hydraulic systems, and cosmetics, further broadening its market scope. Demand is particularly strong in developing regions, where rapid industrialization and urbanization are fueling consumption.

The market is characterized by the presence of several major players, including Mitsubishi Chemical Group Corporation, SABIC, BASF, Sinopec, Reliance, and Shell, among others. Their diverse product portfolios and global reach ensure a competitive landscape and continuous innovation in DEG applications.

Market Segmentation

By Application:

-

Polyester Resins – A major segment, driven by demand in reinforced plastics, coatings, and adhesives.

-

Plasticizers – Used in flexible PVC production.

-

Polyurethanes – Expanding applications in construction and automotive.

-

Lubricants & Coolants – Growing adoption in industrial and automotive cooling systems.

-

Others – Gas dehydration, cosmetics, and chemical intermediates.

By End-use Industry:

-

Construction – Usage in UPR, polyurethanes, and adhesives.

-

Automotive – Lubricants, coolants, and resins.

-

Textile – Fiber processing and resin production.

-

Plastics & Packaging – Plasticizers and polymers.

-

Oil & Gas – Natural gas dehydration applications.

By Region:

-

Asia Pacific dominates the global DEG market, led by China, India, and Japan, due to strong industrial growth and expanding chemical manufacturing.

-

North America and Europe follow, with significant usage in automotive, plastics, and construction.

-

Middle East & Africa show potential growth in natural gas dehydration applications.

Market Trends

-

Increasing focus on eco-friendly and sustainable chemical processes.

-

Rising demand for lightweight plastics and resins in automotive and aerospace.

-

Expanding construction sector driving polyurethane and polyester resin demand.

-

Strategic capacity expansions and joint ventures by leading DEG producers.

Competitive Landscape

Key players in the Diethylene Glycol market include:

-

SABIC

-

Royal Dutch Shell

-

Dow Chemical Company

-

Reliance Industries Limited

-

LyondellBasell Industries

-

Formosa Plastics Corporation

These companies are focusing on R&D, partnerships, and product innovations to strengthen their market position.

The Diethylene Glycol market is set for robust growth between 2025 and 2032, supported by its expanding applications in resins, polyurethanes, and plasticizers. Asia Pacific will continue to dominate, while technological advancements and regulatory compliance will shape the competitive dynamics of the market.

Information Source: https://www.fortunebusinessinsights.com/diethylene-glycol-market-113453

KEY INDUSTRY DEVELOPMENTS

- January 2024 – SABIC announced its decision to invest USD 6.5 billion to establish a petrochemical complex in China's Fujian province. This petrochemical complex will have the capability of producing ethylene glycol along with polyethylene, polypropylene and polycarbonate, among others.

- December 2023 – SABIC announced that they have signed a MoU with Scientific Design (SD) and Linde Engineering. As part of this collaboration, these companies will explore the opportunities to decarbonize ethylene oxide and ethylene glycol production.

Comments

0 comment