views

Middle East Renewable Energy Market Overview

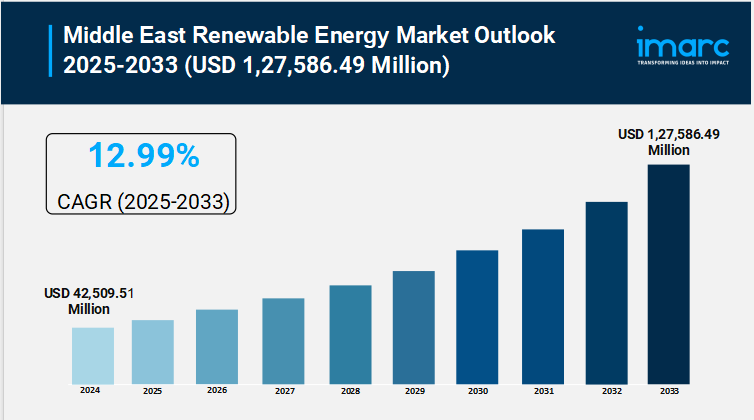

Market Size in 2024: USD 42,509.51 Million

Market Size in 2033: USD 1,27,586.49 Million

Market Growth Rate 2025-2033: 12.99%

According to IMARC Group's latest research publication, "Middle East Renewable Energy Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033",The Middle East renewable energy market size was valued at USD 42,509.51 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,27,586.49 Million by 2033, exhibiting a CAGR of 12.99% during 2025-2033.

How Clean Technology is Transforming the Future of Middle East Renewable Energy Market

-

Accelerating Solar Dominance: Solar power commands 53.8% market share as countries like UAE and Saudi Arabia deploy massive photovoltaic installations, with solar costs dropping significantly and efficiency improvements making desert regions ideal for large-scale generation.

-

Powering Industrial Transformation: Industrial sector leads with 50.9% market share as energy-intensive industries like petrochemicals, cement, and aluminum manufacturing transition to renewables through corporate power purchase agreements and sustainability mandates.

-

Green Hydrogen Revolution: Saudi Arabia's $8.4 billion NEOM Green Hydrogen Project, now 80% complete, will produce carbon-free fuel using 4 GW of renewable energy, positioning the region as a global hydrogen export hub.

-

Smart Grid Integration: Advanced energy storage and smart grid technologies are solving renewable reliability challenges, enabling better grid integration and supporting distributed generation models across urban and remote areas.

-

Regional Leadership Emergence: Iran dominates with 33.3% market share, leveraging abundant solar and wind resources, while countries install 600 MW of new solar capacity annually to meet growing electricity demand.

Grab a sample PDF of this report: https://www.imarcgroup.com/middle-east-renewable-energy-market/requestsample

Middle East Renewable Energy Market Trends & Drivers:

- The Middle East's renewable energy sector is experiencing unprecedented momentum, driven by strategic government initiatives and massive infrastructure investments. Countries across the region are rolling out ambitious national energy strategies like Saudi Arabia's Vision 2030 and the UAE Energy Strategy 2050. These aren't just policy documents – they're backed by serious money. Saudi Arabia's Public Investment Fund raised $3 billion in green bonds in 2022 and another $5 billion in 2023, with over $5.2 billion already allocated to environmental projects. The UAE's National Demand Side Management Programme has cut 11.2 million tonnes of CO₂ emissions, showing these initiatives deliver real results. This government-led push is creating a supportive ecosystem with feed-in tariffs, tax credits, and streamlined approval processes that make renewable projects financially attractive and operationally feasible.

- The region's industrial transformation is another major growth engine, with energy-intensive sectors leading the charge toward clean energy adoption. Industries like petrochemicals, aluminum smelting, and manufacturing are increasingly signing corporate power purchase agreements to secure stable, clean energy at competitive prices. This shift isn't just about environmental compliance – it's about operational resilience and cost management. Companies are discovering that renewables offer energy security and predictable pricing that traditional fossil fuels can't match. The growing emphasis on ESG goals and international sustainability standards is further accelerating this industrial transition, creating a ripple effect that's reshaping entire supply chains across the Middle East.

- Technological breakthroughs are making renewable energy more viable and cost-effective than ever before. The International Energy Agency predicts that by 2030, photovoltaic power generation in the Middle East will contribute over 10% of global new renewable capacity. Advanced solar panel efficiency, improved wind turbine output, and breakthrough energy storage solutions are driving down the levelized cost of electricity, making renewables genuinely competitive with fossil fuels. Smart grid technologies and microgrid systems are enabling distributed generation models that enhance energy security while reducing transmission losses. This technological evolution is particularly powerful in the Middle East's unique geographic context, where abundant solar irradiance and strong wind corridors provide natural advantages for renewable energy development.

Middle East Renewable Energy Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Hydro Power

- Wind Power

- Solar Power

- Bioenergy

- Others

End User Insights:

- Industrial

- Residential

- Commercial

Breakup by Country:

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

Recent News and Developments in Middle East Renewable Energy Market

-

May 2025: Iran installed 600 MW of solar power capacity, quadrupling its previous annual average as part of government efforts to meet rising electricity demand. The Energy Ministry announced plans to develop 5,000 MW of solar capacity with $96 billion in government funding, including construction of 297 MW across five provinces.

-

June 2025: Saudi Arabia's NEOM Green Hydrogen Project reached 80% completion, marking significant progress toward becoming the world's largest carbon-free fuel facility. The $8.4 billion project, powered by 4 GW of clean energy capacity, is scheduled for completion by mid-2026 with first green ammonia shipments beginning in 2027.

-

June 2025: Saudi Arabia's Voluntary Carbon Market signed a landmark agreement with NEOM's energy subsidiary Enowa to deliver over 30 million tons of carbon credits by 2030. This partnership supports the Kingdom's net-zero goals and represents a major step in scaling the region's carbon market through the new carbon credit exchange platform launched in 2024.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Comments

0 comment