Market Overview 2025-2033

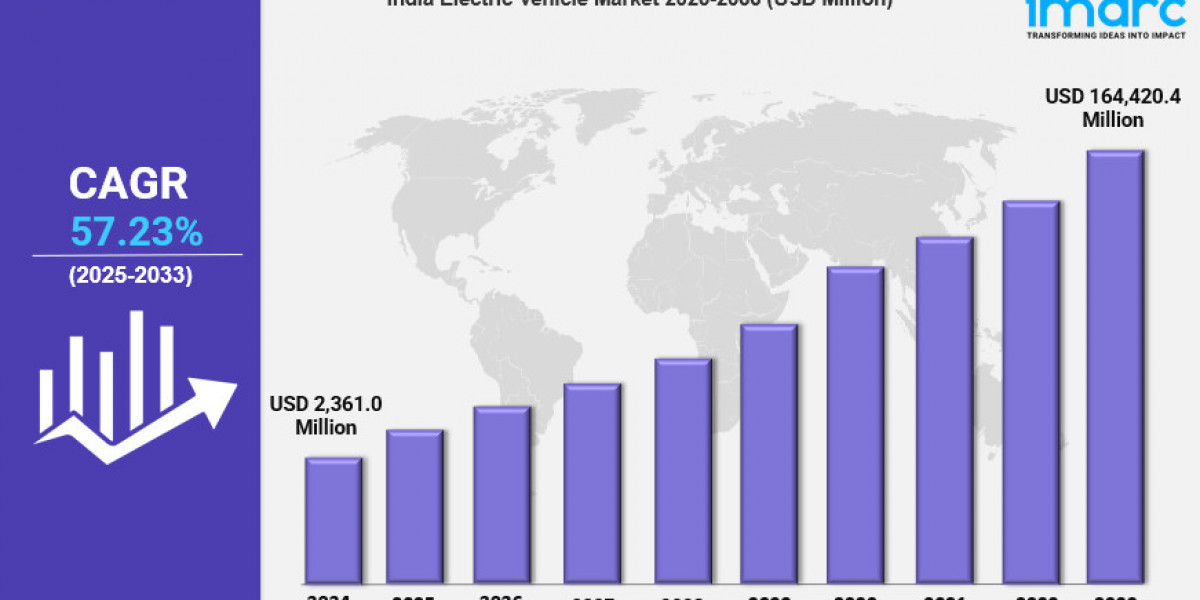

The India electric vehicle market size reached USD 2,361.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 164,420.4 Million by 2033, exhibiting a growth rate (CAGR) of 57.23% during 2025-2033. The rising demand for fuel-efficient and high-performance vehicles, increased environmental consciousness among the public, and the expanding network of EV charging stations in India are significant factors propelling the market forward.

Key Market Highlights:

✔️ Growing consumer interest in environmentally friendly and sustainable transportation options

✔️ Innovations in battery technology improving range, efficiency, and affordability

✔️ Increased participation of both local and international automakers in the electric vehicle sector

✔️ Swift expansion of electric two-wheelers and three-wheelers for urban mobility

Request for a sample copy of this report: https://www.imarcgroup.com/india-electric-vehicle-market/requestsample

India Electric Vehicle Market Trends and Drivers:

Rising Prices of Fuel

The rising fuel prices in India are significantly boosting the India electric vehicle market size. As gasoline and diesel costs continue to escalate, more consumers are turning to electric vehicles as a cost-effective alternative. For instance, in the fiscal year 2023, the high-speed diesel oil wholesale price index in India exceeded INR 191, reflecting a 91% increase since 2012. This shift is driven by the lower operating costs associated with EVs, which include reduced fuel expenses and lower maintenance costs compared to internal combustion engine (ICE) vehicles. Additionally, the surging price of crude oil has further shifted demand towards electric vehicles. In fiscal year 2023, the average price of Indian basket crude oil was projected at USD 97.67 per barrel, significantly higher than the previous year's average of USD 78.19 per barrel. Advances in battery technology are also enhancing the appeal of EVs, addressing consumer concerns about range anxiety and convenience. For instance, in March 2024, MG Motor India launched the new Excite Pro variant of the MG ZS EV, featuring fast charging capabilities with a 50.3 kWh battery pack that offers a range of 461 km on a single charge, charging to 80% in just 60 minutes with a 50-kW charger. These factors are positively influencing the India electric vehicle market overview.

Increasing Government Initiatives

The Indian government is implementing various initiatives to promote the adoption of electric vehicles and develop charging infrastructure, enhancing the electric vehicle market size in India. For example, in February 2024, the Ministry of Heavy Industries launched the Electric Mobility Promotion Scheme (EMPS) 2024, a fund-limited initiative with a total of INR 500 Crores (about USD 60.24 million) aimed at accelerating the adoption of electric two-wheelers and three-wheelers. This initiative seeks to bolster the nation's EV manufacturing ecosystem and promote green mobility. Furthermore, advancements in charging technologies, such as fast chargers and battery swapping stations, are making EVs more convenient for consumers and alleviating range anxiety. In May 2024, Exicom launched Harmony Gen 1.5 DC, India's fastest DC charger with a capacity of up to 400 kW, equipped with an advanced AI-driven remote management system. These developments are contributing to the growth of the industry. According to the India electric vehicle market analysis, rapid urbanization and the establishment of smart cities in India are creating a favorable environment for electric vehicle adoption. Smart city projects often incorporate EV charging infrastructure into their urban planning, as demonstrated by Hyundai Motor India's launch of 11 ultra-high-speed public EV charging stations across key highways and six major cities in February 2024. These initiatives are further enhancing the India electric vehicle market share.

Development of Self-Driving Electric Vehicle Technology

The integration of self-driving capabilities in electric vehicles adds an extra layer of convenience and comfort for consumers, making them more appealing compared to traditional vehicles. Autonomous features can potentially reduce operational costs for both businesses and individual owners. For example, features like autonomous driving and parking can lead to improved fuel efficiency, lower maintenance costs, and reduced labor expenses across the transportation and logistics sectors. An industry report suggests that driverless taxis could cut ride costs by as much as 40%, offering the potential to transform urban transportation in India. In April 2024, Ola launched the 'Ola Solo,' touted as 'India's first autonomous electric scooter,' which incorporates advanced AI capabilities for a smarter, safer, and more convenient journey. Powered by an in-house built chip called the LMA09000, the Solo uses artificial intelligence to navigate streets, with its adaptive system, JU-GUARD, continually learning from each ride to enhance efficiency and performance. Additionally, in 2023, Minus Zero, an AI start-up based in Bengaluru, introduced India's first autonomous vehicle, the zPod, which boasts a camera-sensor suite capable of achieving Level 5 autonomy, allowing it to operate without human intervention in any driving condition. These innovations are significantly bolstering the India electric vehicle market revenue.

India Electric Vehicle Market Future Outlook

The India Electric Vehicle Market Future Outlook appears promising, with continued growth anticipated across various segments. As consumer preferences shift towards sustainability and technological advancement, the demand for electric vehicles is expected to rise. The India electric vehicle market size is projected to expand further, driven by ongoing government initiatives, advancements in charging infrastructure, and the integration of self-driving technology. The increasing focus on reducing carbon emissions and reliance on fossil fuels will further propel electric vehicle adoption. Additionally, as battery technology continues to improve, offering longer ranges and faster charging times, consumer confidence in EVs is likely to grow. Overall, the future of the electric vehicle market in India looks bright, characterized by innovation, increased accessibility, and a strong commitment to sustainable mobility solutions.

Speak to an analyst : https://www.imarcgroup.com/request?type=report&id=5074&flag=C

India Electric Vehicle Industry Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Vehicle type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Others

Price Category Insights:

- Mid-Range

- High/Luxury Range

Propulsion Type Insights:

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-In Hybrid Electric Vehicle

Regional Insights:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Some of Key Players in the Market:

- Ampere Vehicles Private Limited (Greaves Cotton Limited)

- Ather Energy Pvt Ltd

- Atul Auto Limited

- Bajaj Auto Limited (Bajaj Group)

- Electrotherm (India) Ltd.

- Hero Electric (Hero Eco Group)

- Hyundai Motor India Limited (Hyundai Motor Company)

- JBM Auto Limited

- Mahindra Electric Mobility Limited (Mahindra & Mahindra Ltd)

- MG Motor India Pvt Ltd (SAIC Motor Corporation Limited)

- Okinawa Autotech Pvt Ltd

- Olectra Greentech Ltd.

- Piaggio Vehicles Pvt. Ltd. (PIAGGIO & C. SPA)

- Tata Motors Limited (Tata Group)

- TVS Motor Company (Sundaram - Clayton Limited)

- VE Commercial Vehicles Limited

Trending Reports By IMARC Group:

India Basmati Rice Market: https://www.imarcgroup.com/india-basmati-rice-market

India Drones Market: https://www.imarcgroup.com/india-drones-market

India Data Center Market: https://www.imarcgroup.com/india-data-center-market

India Furniture Market: https://www.imarcgroup.com/india-furniture-market

India E-Commerce Market: https://www.imarcgroup.com/india-e-commerce-market

India Home Decor Market: https://www.imarcgroup.com/india-home-decor-market

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion. IMARC's services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145