Customer Service Excellence: Tackling Problems with Precision

-

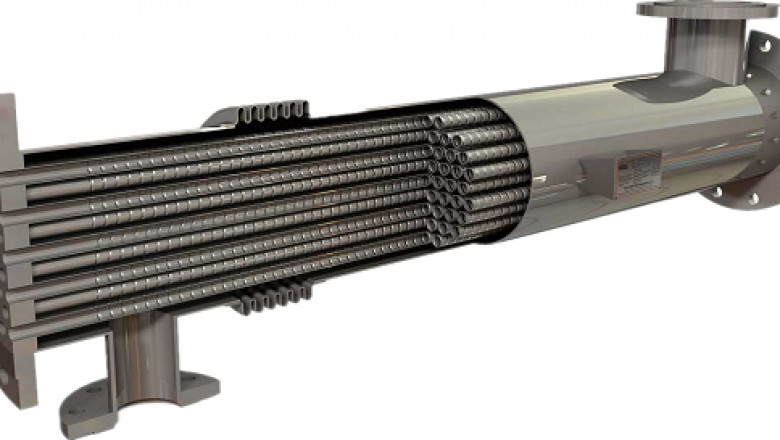

The heat exchanger market size is projected to reach US$ 39.11 billion by 2...

Achetez des vêtements Davrilsupply en ligne au prix soldé. Bénéficiez de 30...

Achetez la casquette Vrunk de haute qualité à un prix soldé. Obtenez jusqu'...

The Coating Additives Market is expected to register a CAGR of 4.7% from 20...

The Coating Resins Market is expected to register a CAGR of 5.7% from 2025...

Offshore wind turbines are used in wind farms construction, off the shore,...

VertiAid is suitable for both occasional episodes and chronic cases of vert...

CelluFend is a revolutionary topical solution formulated to visibly reduce...